vermont state tax department

Number of employees at Vermont Taxes Department in year 2021 was 176. MyVTax Payment Portal Vermontgov Freedom and Unity.

Vt Tax Dept Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Sun Community News Montpelier The Vermont Department Of Taxes Last Week Mailed 1099 G Forms To 21 000 Taxpayers That

Highest salary at Vermont Taxes Department in year 2021 was 131142.

. Generally the Department processes e-filed returns in about 6-8 weeks while paper returns typically take about 8-12 weeks. Use myVTax the departments online portal to electronically pay personal income tax estimated tax and business taxes. The Department will begin processing.

Below you will find information about the various taxes for businesses and corporations operating in Vermont. The mission of the Vermont Department of Taxes is to provide a fair and efficient tax system that enhances Vermonts economic growth. Several states including Florida will collect taxes equal to the rate of your home state.

The Vermont Department of Taxes serves Vermonters by collecting about 30 state tax types to pay for the goods and services people receive from the state. In addition to personal business. Vermont School District Codes.

Click here for phone number s Local. Sign Up for Email Updates. W-4VT Employees Withholding Allowance Certificate.

Check My Refund Status. State unemployment taxes are paid to this Department and deposited into a trust fund that can only be used for the payment. IN-111 Vermont Income Tax Return.

Property assessments include two components-the. If you are doing business in Vermont you are likely. PA-1 Special Power of Attorney.

The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal. A property tax is a levy on property that the owner is required to pay with rates set as a percentage of the home value. Vermont State Parks Explore our state parks and immerse yourself in the beauty of Vermont.

Average annual salary was 52582 and. Freedom and Unity Live. Business Tax Center Find guidance on paying taxes as a business in Vermont.

Employers pay two types of unemployment taxes. Vermont Department of Taxes VT Taxation phone. That tax money is.

To request exemption of tax because the tax was paid to another state the vehicle was received as a gift the vehicle is equipped with altered controls or a mechanical lifting. Send us a Message. In this example the Vermont tax is 6 so they will charge you 6 tax.

Vermont Department of Taxes.

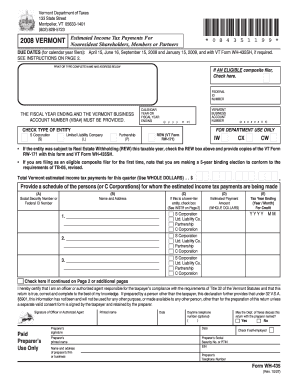

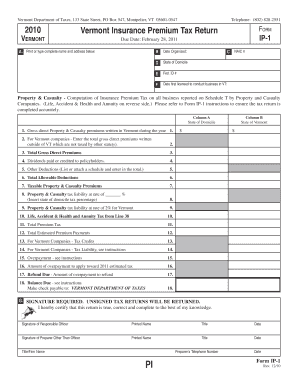

Fillable Online Tax Vermont Vermont Department Of Taxes 133 State Street Montpelier Vt 05633 1401 802 828 5723 2008 Vermont Estimated Income Tax Payments For Nonresident Shareholders Members Or Partners 084351199 0 8 4 3 5 1 1 9 9 If An

Fillable Online State Vt Request Taxpayer Advocate Services Vermont Department Of Taxes Fax Email Print Pdffiller

You Don T Need To Respond To A Vt Tax Questionnaire Msk Attorneys

Free Vermont Tax Power Of Attorney Form Pa 1 Pdf Eforms

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Department Of Taxes Montpelier Vt Facebook

Filing A Vermont Income Tax Return Things To Know Credit Karma

Vermont Promotes Free Tax Preparation Help Vtdigger

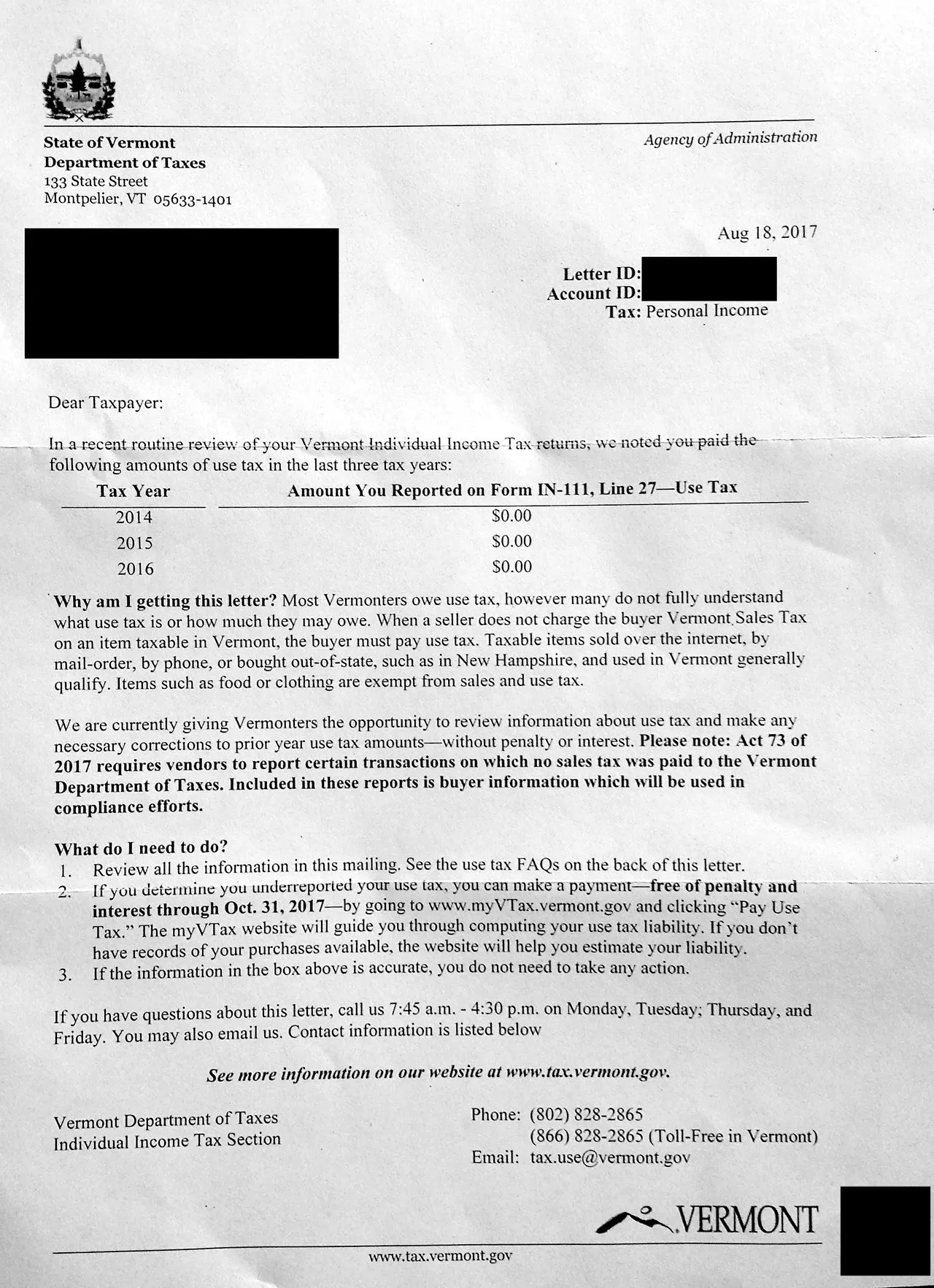

Vermont Tax Commissioner Reminds Vermonters To Pay Use Tax Vermont Business Magazine

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont S Budget Has A Few Wealthy People To Thank

Vt Dept Of Taxes Vtdepttaxes Twitter

Fillable Online Vermont Department Of Taxes 133 State Street Po Box 547 Montpelier Vt 05601 0547 Fax Email Print Pdffiller

Vermont Tax Department Sends Letters Seeking Unpaid Sales Tax Off Message

Vermont Announces Bonus Round Of State Tax Credits

Vermont Department Of Taxes Facebook

Vermont Department Of Taxes 24 Visitors